Marathon Digital Acquires $618M in Bitcoin, Expands Corporate Treasury

Bitcoin mining giant Marathon Digital has purchased $618 million worth of Bitcoin at an average price of $95,352 per BTC. This acquisition raises its corporate BTC treasury to $3.3 billion, solidifying its position as the second-largest corporate Bitcoin holder after MicroStrategy.

Bitcoin mining powerhouse Marathon Digital Holdings has made headlines with its bold acquisition of 6,484 Bitcoin, valued at $618 million. According to an SEC filing, the Florida-based company paid an average of $95,352 per Bitcoin, including fees and expenses. This substantial purchase boosts its corporate Bitcoin treasury to a staggering $3.3 billion, cementing Marathon’s position as the second-largest corporate holder of Bitcoin globally.

Online advertising service 1lx.online

Strategic Move Amid Market Volatility

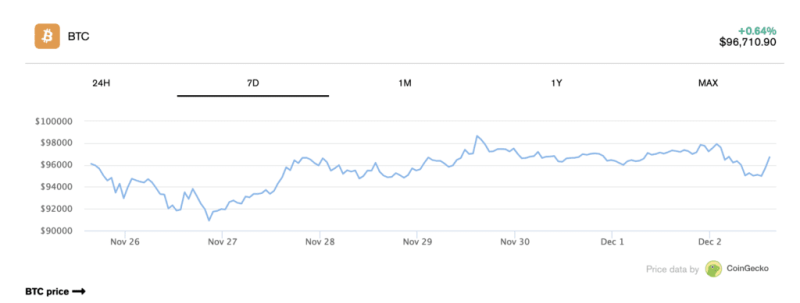

The acquisition comes at a time when Bitcoin’s price is hovering just below $95,000, following a recent peak above $98,000, according to CoinGecko data. Marathon appears to have capitalized on the cryptocurrency’s upward momentum, underscoring its commitment to long-term Bitcoin investment.

The announcement had a positive impact on Marathon’s stock (MARA), which trades on the Nasdaq. Shares rose 1.9% during European trading hours on Monday, effectively erasing a 2% dip from the previous Friday’s close at $26.85.

$700M Fundraising Initiative

In addition to its Bitcoin acquisition, Marathon revealed plans to raise up to $700 million through private offerings to institutional buyers. According to the SEC filing, the proceeds will serve multiple strategic purposes:

- $50 million will go toward repurchasing a portion of existing convertible notes due in 2026.

- The remaining funds will be allocated for acquiring additional Bitcoin, as well as general corporate purposes, including working capital, strategic acquisitions, asset expansion, and debt repayment.

This isn’t Marathon’s first foray into convertible notes. In November, the company announced an $850 million offering, with the potential to expand it to $1 billion, signaling a consistent strategy of leveraging debt to grow its Bitcoin reserves.

The Race for Bitcoin Supremacy

Despite Marathon’s aggressive moves, it remains a distant second to MicroStrategy, the software company led by Bitcoin evangelist Michael Saylor. MicroStrategy’s Bitcoin holdings are valued at a staggering $37 billion, dwarfing Marathon’s $3.3 billion treasury.

Nevertheless, Marathon’s recent purchase underscores the growing trend of institutional Bitcoin adoption. The company’s dual strategy of mining and treasury accumulation highlights its bullish outlook on Bitcoin’s long-term value.

Market Impact and Future Outlook

The cryptocurrency market has been on a bullish streak, with Bitcoin prices surging amid renewed investor optimism. Marathon’s acquisition reflects confidence in Bitcoin’s potential as a store of value and a hedge against inflation.

However, analysts warn that Marathon’s high acquisition price of $95,352 per Bitcoin could pose risks if market conditions falter. Still, the company’s robust strategy of raising capital and expanding its Bitcoin holdings may position it well for future gains.

As Bitcoin continues its push toward the $100,000 milestone, Marathon’s bold move adds another chapter to the narrative of institutional crypto adoption.

Unser Schöpfer erstellt erstaunliche NFT-Sammlungen!

Unterstütze die Redakteure - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Binance – 100$ gratis (exklusiv): Melden Sie sich über diesen Link an und erhalten Sie 100 $ gratis und 10 % Rabatt auf Ihre Binance Futures-Gebühren für den ersten Monat (Allgemeine Geschäftsbedingungen).

Bitget – Nutzen Sie diesen Link, nutzen Sie das Rewards Center und gewinnen Sie bis zu 5027 USDT!

(Rezension)

Registrierung OHNE SANKTIONSRISIKO an der Bybit-Börse: Verwenden Sie diesen Link (alle möglichen Rabatte auf Provisionen und Boni bis zu 30.030 USD inbegriffen). Wenn Sie sich über die Anwendung registrieren, geben Sie bei der Registrierung einfach in das Referenzfeld ein: WB8XZ4 - (manuell)

Quelle – Übersetzt und veröffentlicht ✓