Us Election Momentum: Will Bitcoin Hit $80K In A Week?

The US election results and Fed rate cuts have sparked new optimism in the crypto market, with Bitcoin surging by 12.78% since November 5. Analysts predict BTC could hit $80,000 within days as investors show renewed confidence.

The recent US election and Federal Reserve interest rate cuts have provided a notable boost to the crypto market, particularly impacting Bitcoin. Since November 5, Bitcoin has gained 12.78%, with analysts suggesting it could surge to the $80,000 mark in the coming week. A crypto analyst shared this bullish forecast on X, indicating that the renewed interest could propel Bitcoin to new highs in the short term.

This is why #Bitcoin goes so much higher from here and I see 80k next week.

— James Van Straten (@btcjvs) November 8, 2024

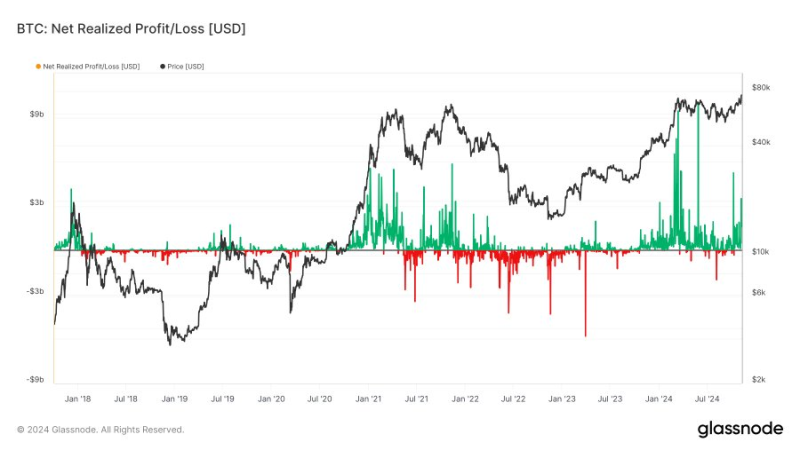

Very little realized profit being taken compared to previous ATHs.

BTC is below the inflation adjusted ATH, its consolidated for 9 months, investors want more.

What is wild, we are seeing less… pic.twitter.com/PXRwExAft9

Over the past month, Bitcoin has grown by an impressive 25.9%. This gain comes amid a trend of low profit-taking, which signals strong investor confidence. Typically, when prices reach perceived highs, investors cash out to lock in profits. However, current data from the Bitcoin Net Realized Profit/Loss chart reveals that profit-taking activity remains relatively low, suggesting that investors anticipate further gains.

Over the past month, Bitcoin has grown by an impressive 25.9%. This gain comes amid a trend of low profit-taking, which signals strong investor confidence. Typically, when prices reach perceived highs, investors cash out to lock in profits. However, current data from the Bitcoin Net Realized Profit/Loss chart reveals that profit-taking activity remains relatively low, suggesting that investors anticipate further gains.

The analyst also pointed out that Bitcoin’s current price remains below its inflation-adjusted all-time high (ATH), indicating even greater potential for growth. Additionally, the last nine months of consolidation have provided stability to Bitcoin, strengthening its base and potentially setting the stage for a sustained bullish run.

Bitcoin’s Market Performance Overview:

In the second year of Bitcoin’s typical four-year cycle, the market generally shows weaker performance. For instance, Bitcoin posted a return of +183.5% in 2012 and +123.8% in 2016. Despite mixed performance in the first three quarters of 2024, Q4 has historically been a strong period for Bitcoin. Last quarter, BTC returned +56.6%, while current momentum hints at continued growth.

From a low of $67,821.68 on November 4, Bitcoin has now seen a 12.78% increase. With Van Straten’s prediction and current market dynamics, $80,000 could be a realistic short-term goal for Bitcoin.

Online advertising service 1lx.online

Unser Schöpfer erstellt erstaunliche NFT-Sammlungen!

Unterstütze die Redakteure - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Binance – 100$ gratis (exklusiv): Melden Sie sich über diesen Link an und erhalten Sie 100 $ gratis und 10 % Rabatt auf Ihre Binance Futures-Gebühren für den ersten Monat (Allgemeine Geschäftsbedingungen).

Bitget – Nutzen Sie diesen Link, nutzen Sie das Rewards Center und gewinnen Sie bis zu 5027 USDT!

(Rezension)

Registrierung OHNE SANKTIONSRISIKO an der Bybit-Börse: Verwenden Sie diesen Link (alle möglichen Rabatte auf Provisionen und Boni bis zu 30.030 USD inbegriffen). Wenn Sie sich über die Anwendung registrieren, geben Sie bei der Registrierung einfach in das Referenzfeld ein: WB8XZ4 - (manuell)

Quelle – Übersetzt und veröffentlicht ✓