Us Bitcoin Etfs Surpass Gold Funds With $130B In Assets Under Management In Record Year

Bitcoin ETFs in the US have overtaken gold ETFs with $130 billion in AuM, reflecting a massive shift toward digital assets as Bitcoin cements its status as “digital gold” in a changing financial landscape.

Bitcoin exchange-traded funds (ETFs) have achieved a historic milestone by surpassing US gold ETFs in assets under management (AuM), reaching $130 billion. This remarkable growth has been achieved in less than a year since Bitcoin ETFs launched in January 2024, compared to gold ETFs, which have been around for over two decades. The achievement underscores the growing confidence of both institutional and individual investors in Bitcoin as the premier “digital gold.”

Digital gold > gold. pic.twitter.com/GFr6CLLot7

— Balaji (@balajis) December 18, 2024

Key Drivers Behind Bitcoin ETFs’ Growth

The rise of Bitcoin ETFs can be attributed to several key factors:

- Institutional Support: Major financial players like BlackRock and Fidelity introduced Bitcoin ETFs, drawing significant interest from institutional investors. Firms like Morgan Stanley and Charles Schwab, managing over $10 trillion collectively, have since begun offering Bitcoin-related products to their clients.

- Changing Investor Preferences: Younger generations increasingly view Bitcoin as a viable alternative to traditional assets such as gold and stocks, especially amid economic uncertainties.

- Macro Factors: Global concerns about inflation, government deficits, and geopolitical instability have driven investors to seek decentralized assets like Bitcoin, which is seen as a hedge against excessive quantitative easing and traditional market risks.

Bitcoin ETFs Lead Digital Asset Integration

Among the newly launched Bitcoin ETFs, BlackRock’s iShares Bitcoin Trust has emerged as the dominant player, managing nearly $60 billion in assets. In November 2024, this ETF surpassed BlackRock’s own iShares Gold Trust, highlighting Bitcoin’s growing appeal.

This trend reflects a broader integration of digital assets into traditional financial systems. For example, MicroStrategy, known for its bold Bitcoin investment strategy, recently secured a position in the NASDAQ 100.

Election Results Propel Crypto Momentum

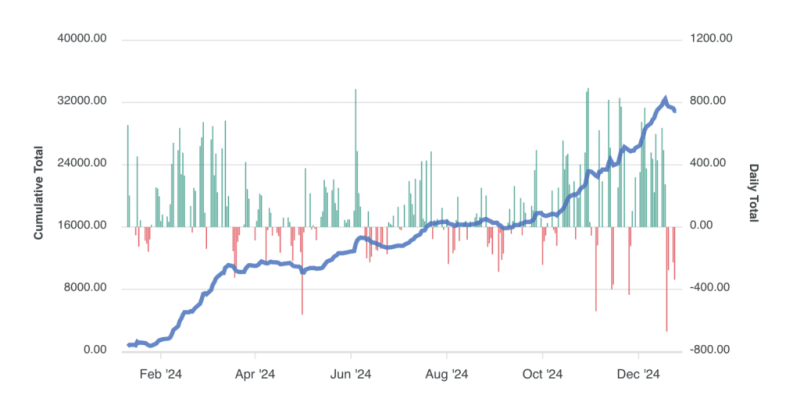

The election of Donald Trump in the United States further bolstered crypto markets. The president-elect has announced plans to establish a national Bitcoin reserve and create a crypto-friendly regulatory environment. These developments have contributed to steady inflows into Bitcoin ETFs since October 2024, despite concerns about volatility.

While Ethereum ETFs trail behind Bitcoin ETFs in total assets, they have also seen consistent inflows over the past month, demonstrating growing interest in alternative digital assets.

A Transformative Year for Digital Assets

The rise of Bitcoin ETFs to $130 billion in AuM marks a transformative year for digital assets. The growing role of Bitcoin as a safe-haven asset, combined with increasing regulatory clarity, positions Bitcoin and other cryptocurrencies as integral parts of modern investment portfolios.

Online advertising service 1lx.online

Unser Schöpfer erstellt erstaunliche NFT-Sammlungen!

Unterstütze die Redakteure - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Binance – 100$ gratis (exklusiv): Melden Sie sich über diesen Link an und erhalten Sie 100 $ gratis und 10 % Rabatt auf Ihre Binance Futures-Gebühren für den ersten Monat (Allgemeine Geschäftsbedingungen).

Bitget – Nutzen Sie diesen Link, nutzen Sie das Rewards Center und gewinnen Sie bis zu 5027 USDT!

(Rezension)

Registrierung OHNE SANKTIONSRISIKO an der Bybit-Börse: Verwenden Sie diesen Link (alle möglichen Rabatte auf Provisionen und Boni bis zu 30.030 USD inbegriffen). Wenn Sie sich über die Anwendung registrieren, geben Sie bei der Registrierung einfach in das Referenzfeld ein: WB8XZ4 - (manuell)

Quelle – Übersetzt und veröffentlicht ✓