Bitcoin Holds Firm At $96,000 Amid $23 Billion Accumulation Surge

Bitcoin stabilizes above $96,000 as investors amass $23 billion worth of BTC, establishing a critical support zone near $96K-$100K despite ongoing market volatility.

Bitcoin has showcased remarkable resilience in recent weeks, holding firm above the $96,000 support level even as the market undergoes significant fluctuations. The cryptocurrency’s stability can largely be attributed to a wave of accumulation valued at $23 billion, marking one of the most substantial buying phases in recent memory.

Online advertising service 1lx.online

Investor Confidence Signals

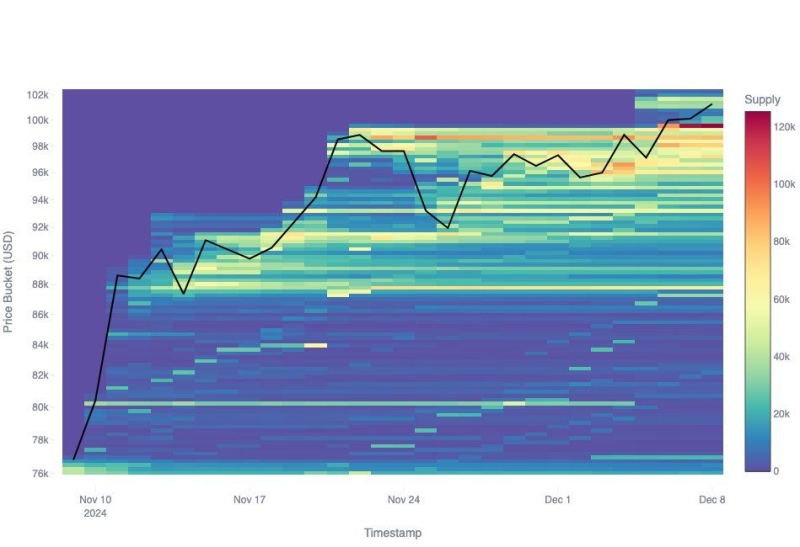

The Cost Basis Distribution (CBD) data highlights a strong bullish sentiment among Bitcoin investors. The $99,559 level has emerged as a key accumulation zone, with 125,000 BTC purchased just below the pivotal $100,000 threshold. Simultaneously, the range between $96,000 and $98,000 has seen substantial activity, with an additional 120,000 BTC accumulated over the past two weeks.

This clustering of buying activity near the $96,000 to $100,000 range underscores its significance as a robust support zone. Such concentrated accumulation serves as a critical buffer against potential price dips, reflecting investors’ confidence in Bitcoin’s long-term prospects.

Realized Profits and Market Volatility

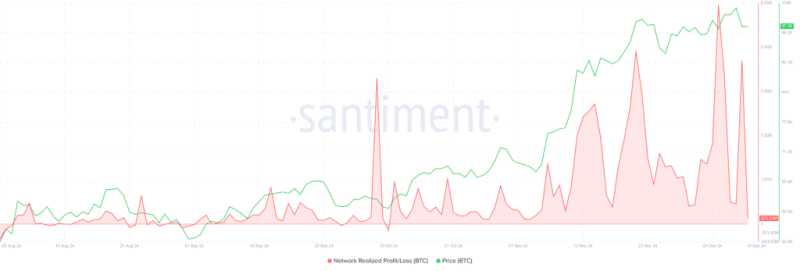

Despite the strong accumulation, the market remains highly active, with realized profits spiking during periods of price growth. While this profit-taking indicates healthy trading activity, it also contributes to short-term price volatility, presenting challenges to Bitcoin’s bullish momentum.

These realized profits suggest that some investors are seizing the opportunity to capitalize on price increases, potentially stalling Bitcoin’s attempts to decisively break above $100,000. Nevertheless, this cyclical behavior is a natural part of market dynamics.

Future Outlook: Key Levels to Watch

Bitcoin’s current position near the $96,000 support level provides a stable foundation for potential upward movement. Should the cryptocurrency hold within the $96,000 to $100,000 range, it may soon attempt another breakout toward the psychological $100,000 mark.

However, resistance at $100,000 remains a significant hurdle. If Bitcoin fails to secure a foothold above this level, it risks remaining in a sideways trading range, fluctuating between $96,000 and $100,000.

Conversely, a successful reclaim of $100,000 could reignite Bitcoin’s bullish trajectory, propelling it toward its next resistance levels and possibly surpassing previous all-time highs. The ongoing accumulation at these key price points signals sustained investor confidence, which could act as a catalyst for further growth in the coming weeks.

Unser Schöpfer erstellt erstaunliche NFT-Sammlungen!

Unterstütze die Redakteure - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Binance – 100$ gratis (exklusiv): Melden Sie sich über diesen Link an und erhalten Sie 100 $ gratis und 10 % Rabatt auf Ihre Binance Futures-Gebühren für den ersten Monat (Allgemeine Geschäftsbedingungen).

Bitget – Nutzen Sie diesen Link, nutzen Sie das Rewards Center und gewinnen Sie bis zu 5027 USDT!

(Rezension)

Registrierung OHNE SANKTIONSRISIKO an der Bybit-Börse: Verwenden Sie diesen Link (alle möglichen Rabatte auf Provisionen und Boni bis zu 30.030 USD inbegriffen). Wenn Sie sich über die Anwendung registrieren, geben Sie bei der Registrierung einfach in das Referenzfeld ein: WB8XZ4 - (manuell)

Quelle – Übersetzt und veröffentlicht ✓